Having a look at the numbers the "loss" is still small compared to the gains you would accumulate in the 10 years after. So having a proper money management in mind this whole drawdown period - although it is pretty long I have to admit - does not turn the strategy into a not working one.

That does not mean, that considering a further look into it in terms of further optimization would not make sense, but no matter how large your sample perios is, there will always be an out of sample period, that could lead to different results.

in this period from 2007 to 2018 he did an optimization with thousands of back tests, and passed the best result, you do not see the negative results, this program does not allow adjustments in the parameters of the 20 strategies that are in their internal, we can help to improve!

What I did was to simply use the program in a period that had not been optimized.

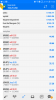

and that was the result